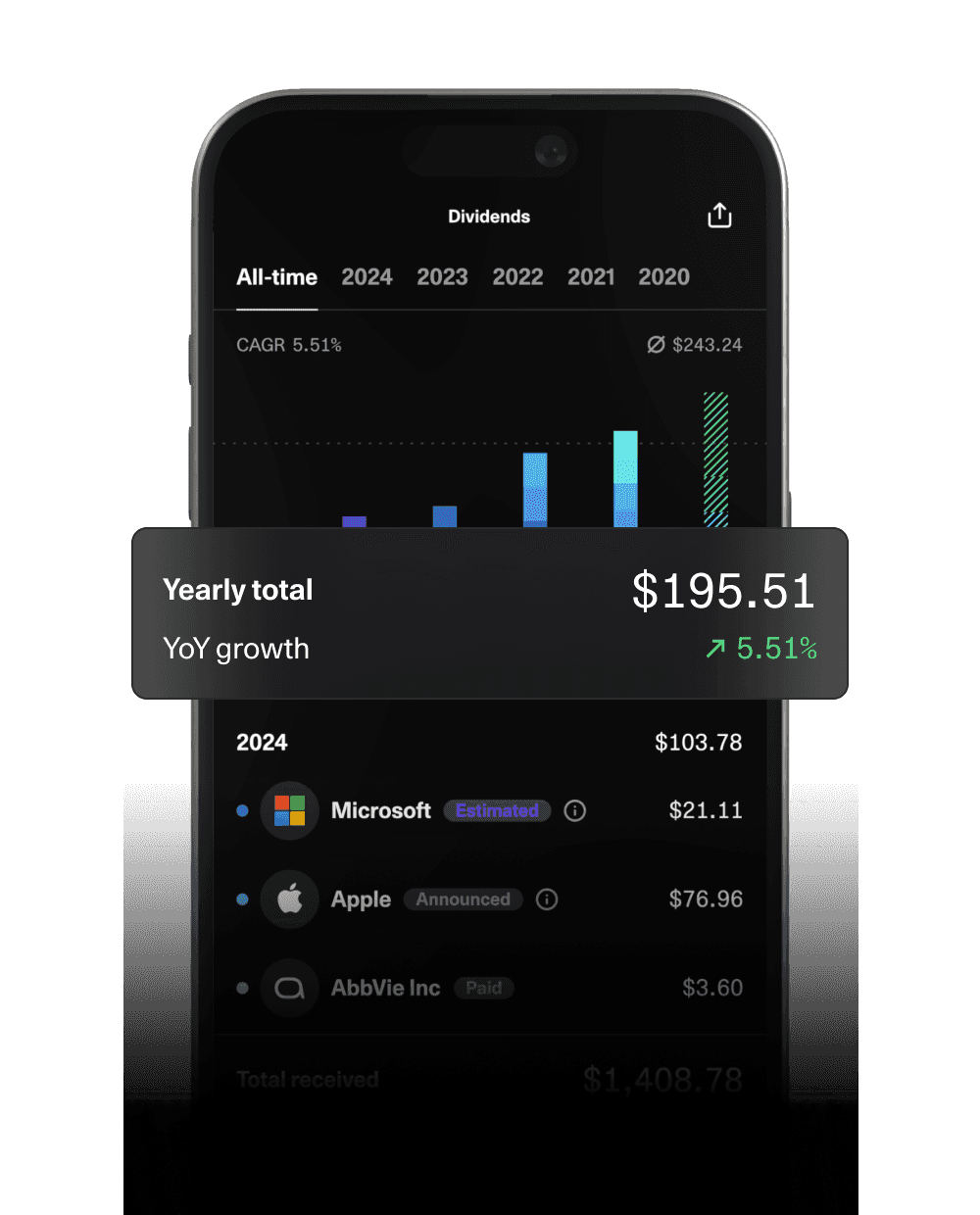

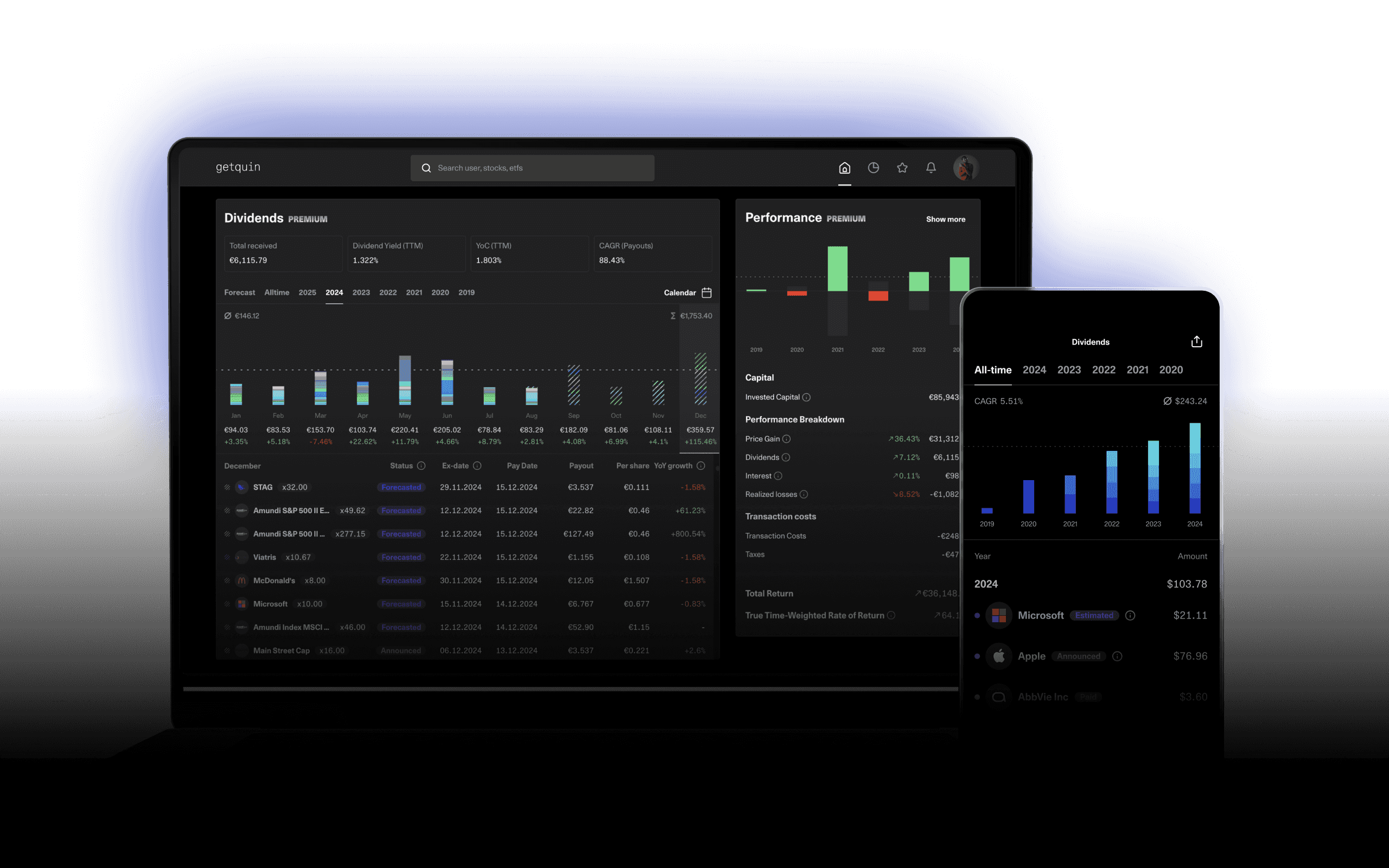

Dividend tracker & calendar

Track all of your portfolio dividends in one place.

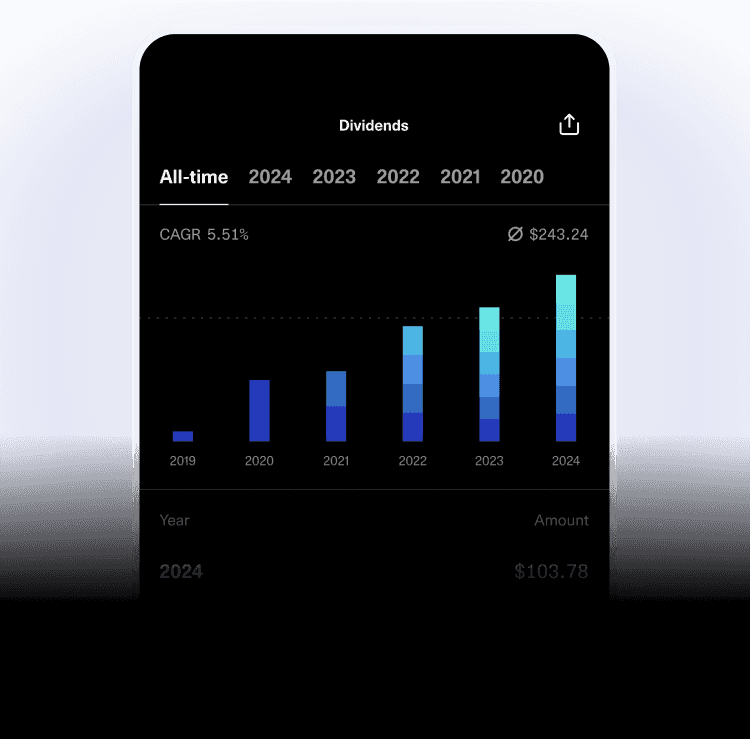

Track past & future dividends

Get an overview of your dividends and keep track of your dividend growth rate, project future cash flows and see their cumulative payouts in clear charts. Your dividend tracker collects all the information accurately and quickly, so you get an ideal overview of your dividends.

Your own dividend calendar

Know exactly when and how much you’ll be getting paid. Stay up to date on latest market information and instantly discover when stocks distribute dividends. Plan future cash flows with the dividend calendar. Get an overview of future dividend payouts and adjust your strategy based on reliable data.

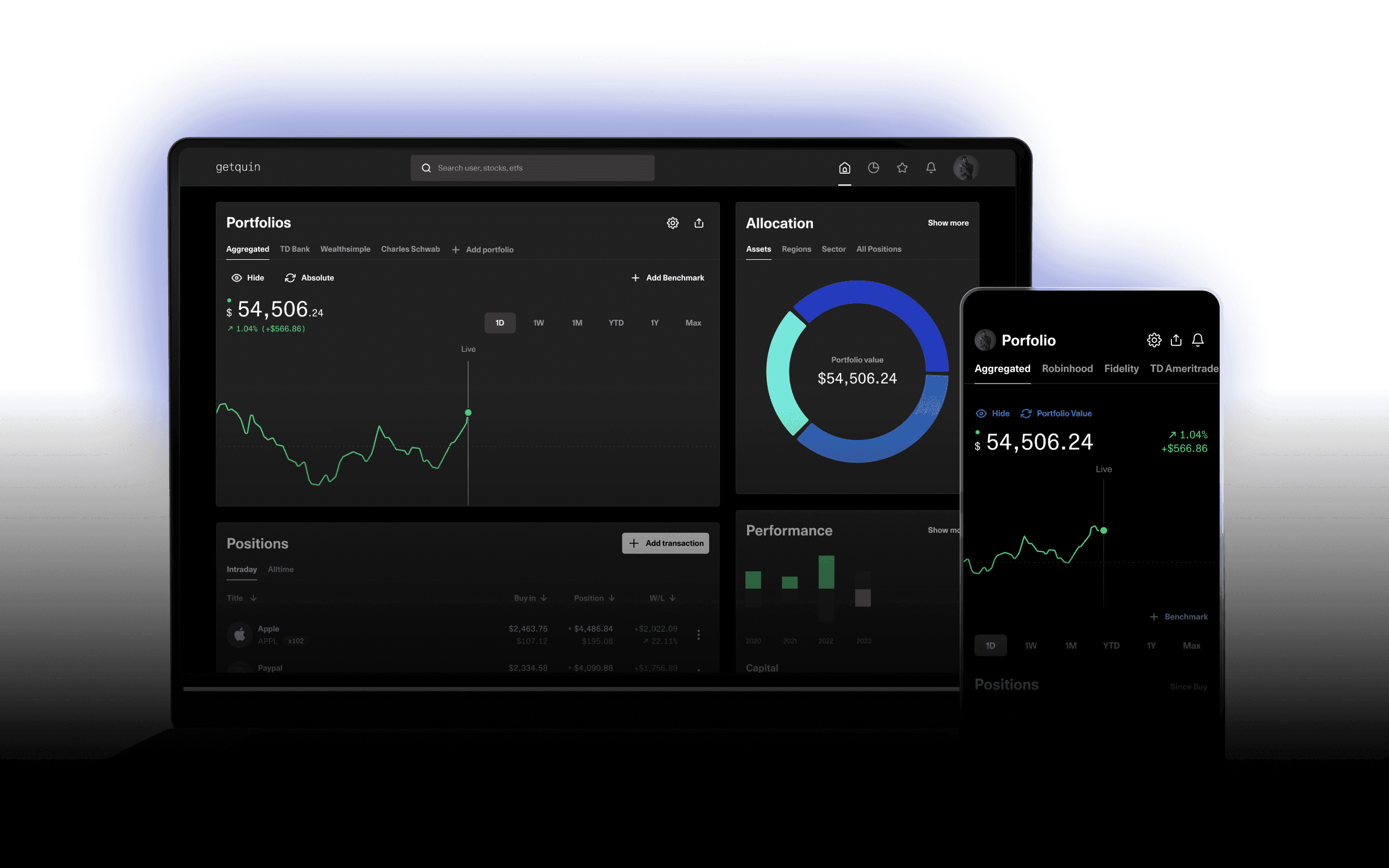

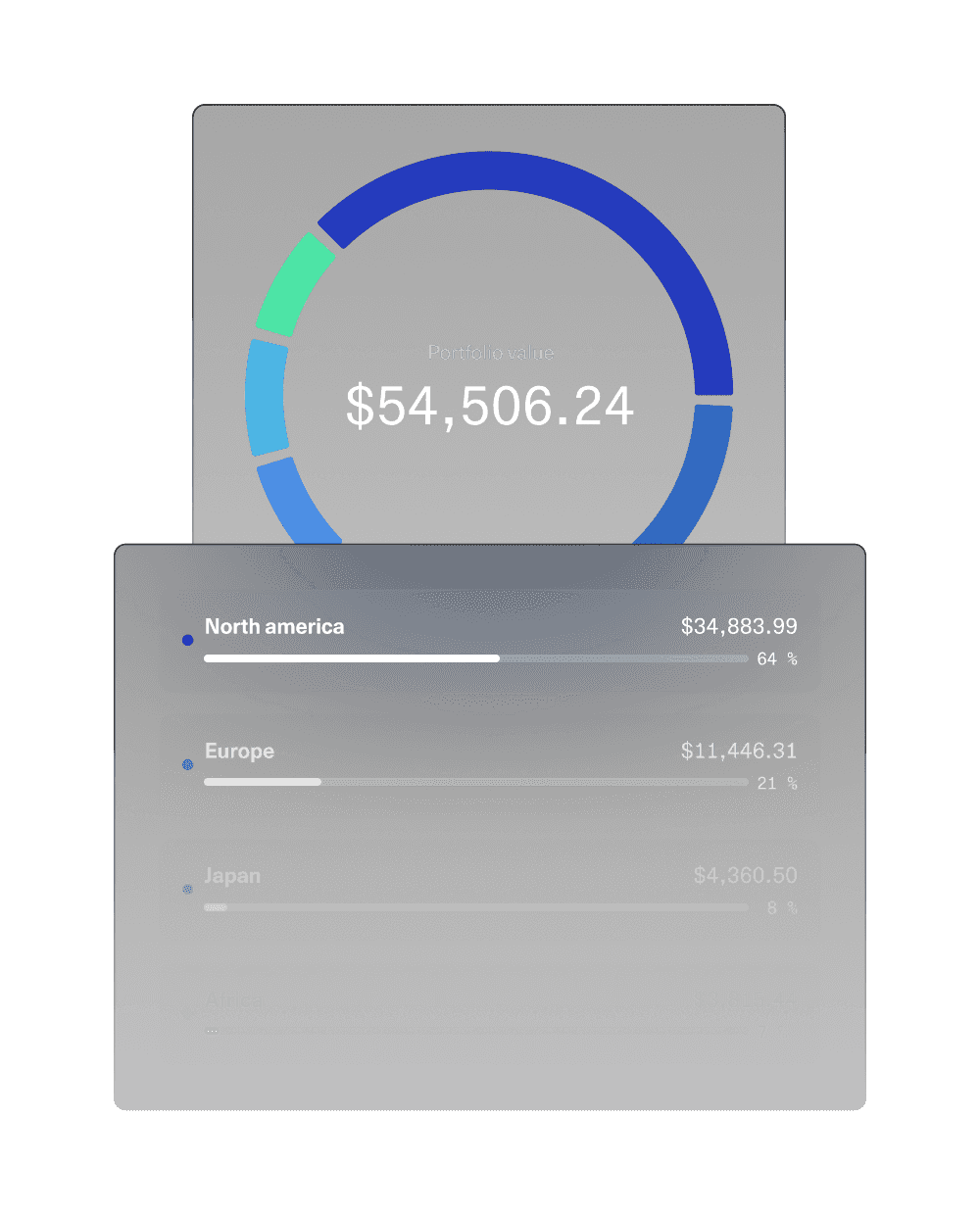

Deep insights into your portfolio

Get detailed portfolio breakdowns based on geography, industry, asset class and track all the numbers that matter in one dashboard. Visualize your holdings in clear charts and adjust your investment strategy based on smart data to optimize your dividend income.

What users love about getquin

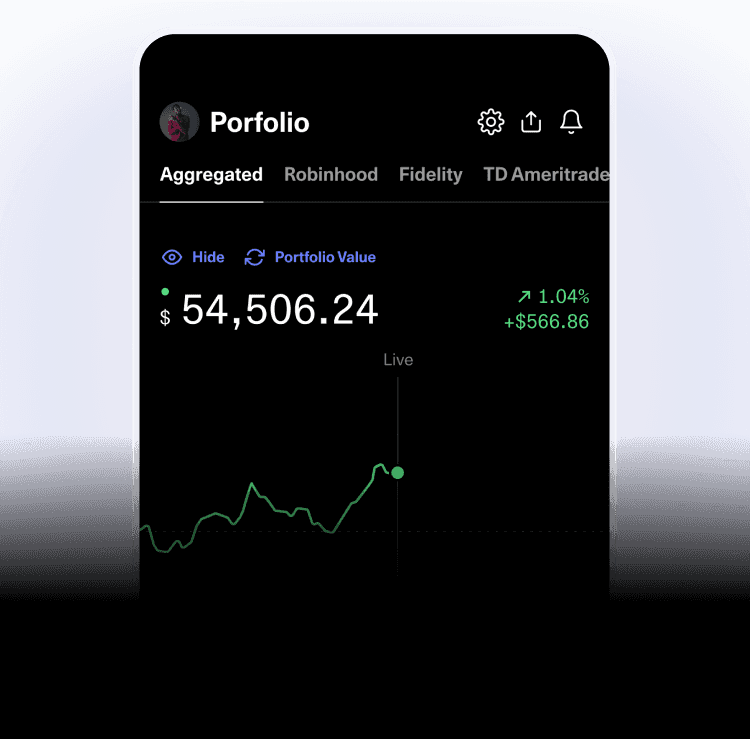

Accessible on all devices

Access our application easily through any web browser or download our lightning fast native iOS or Android app.