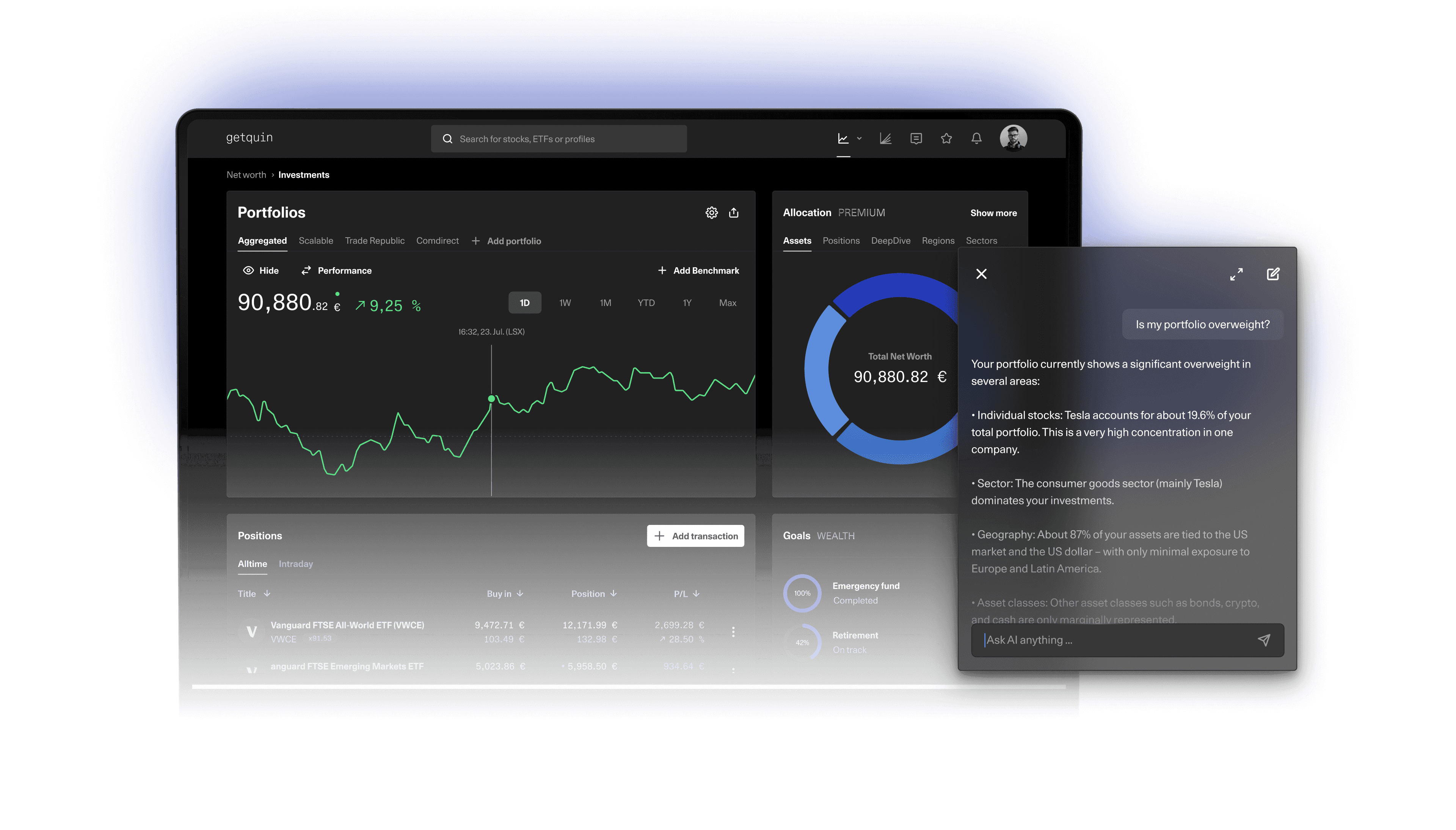

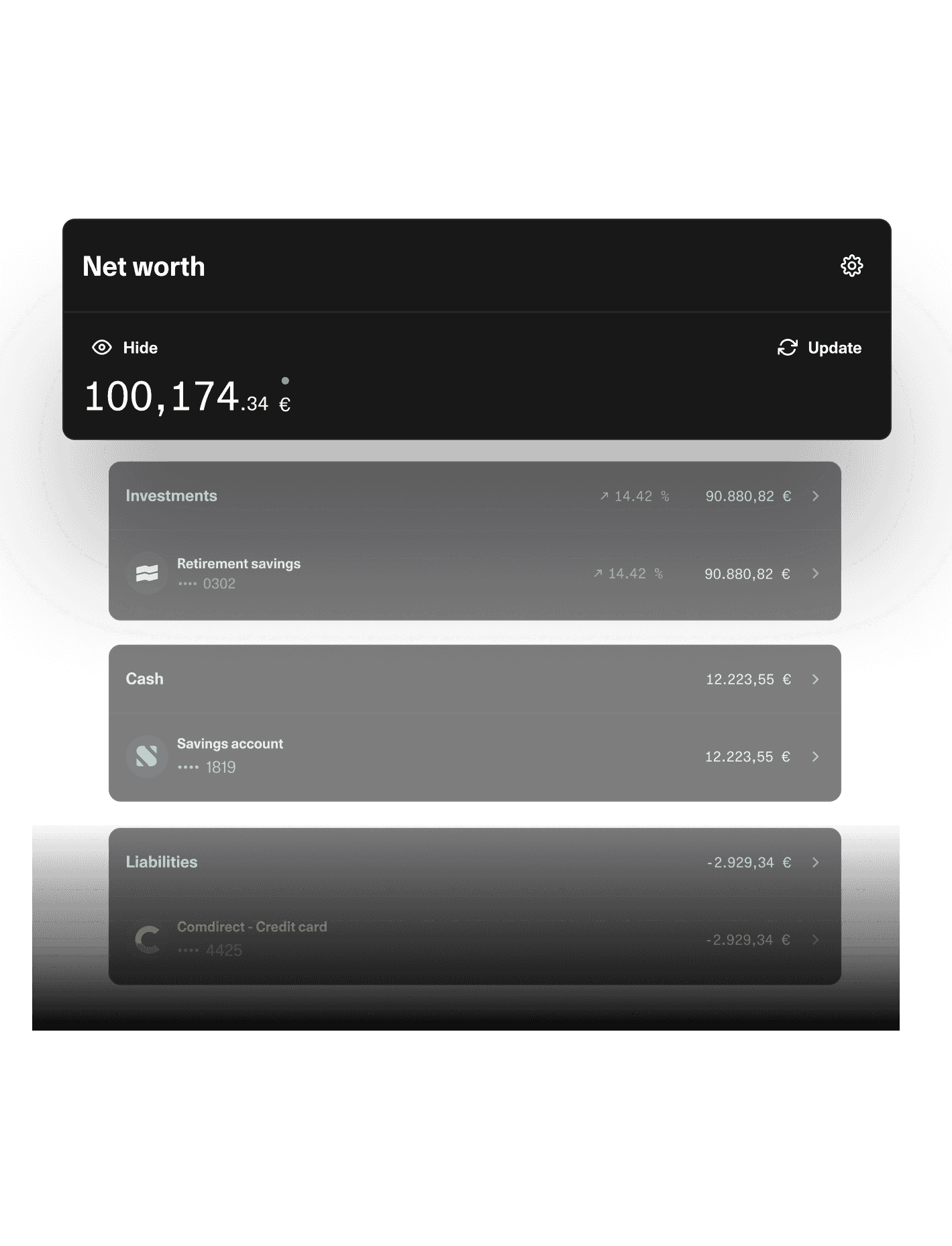

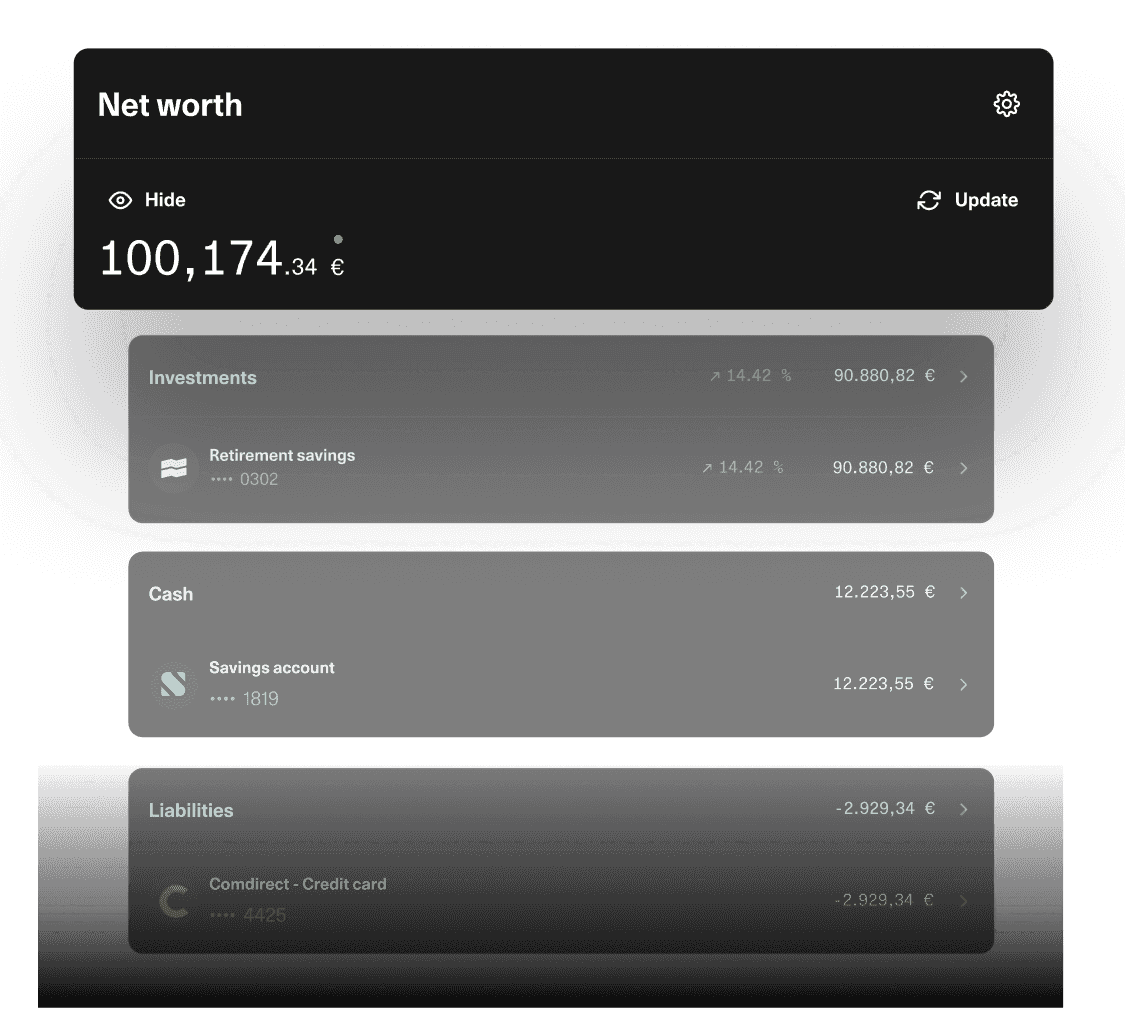

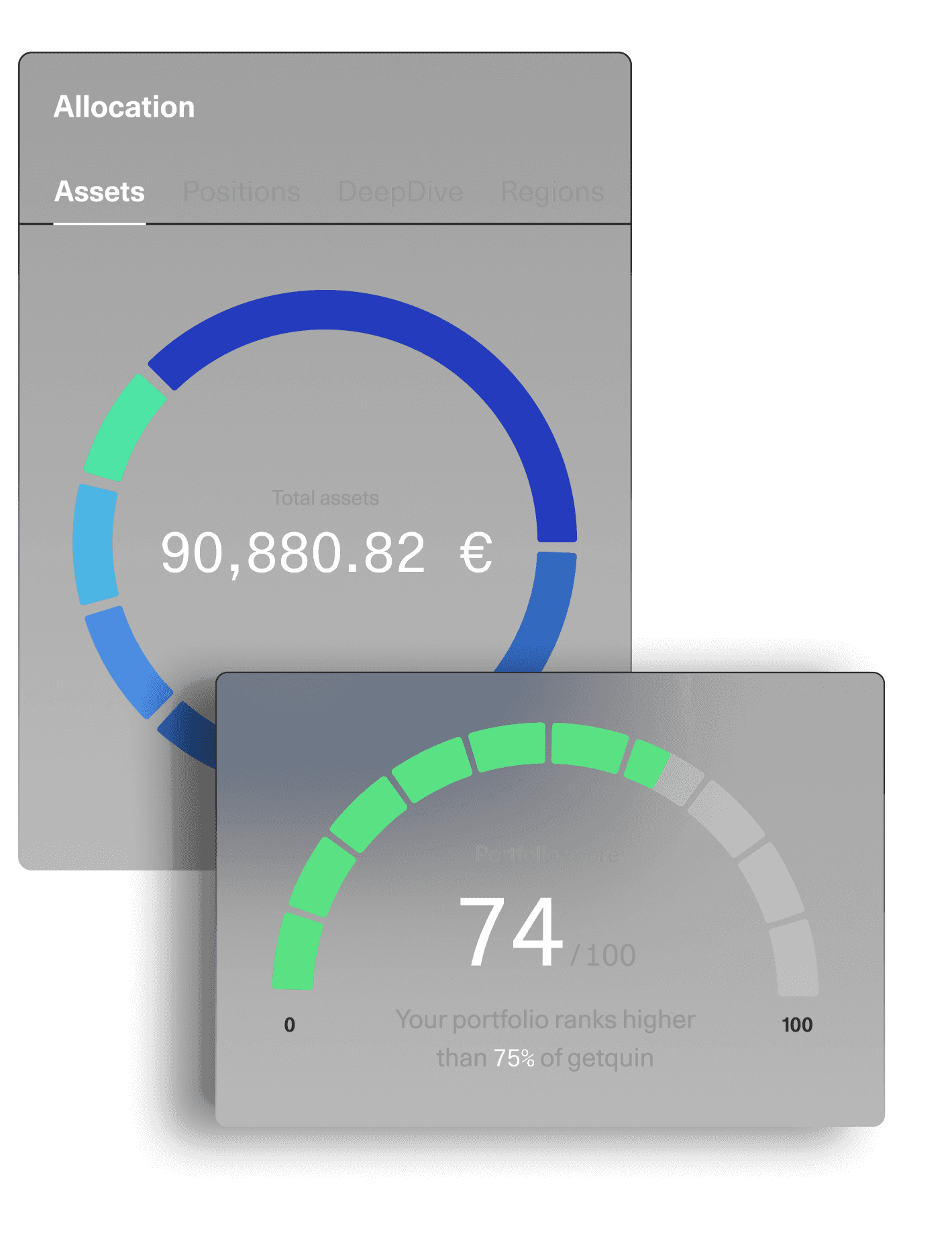

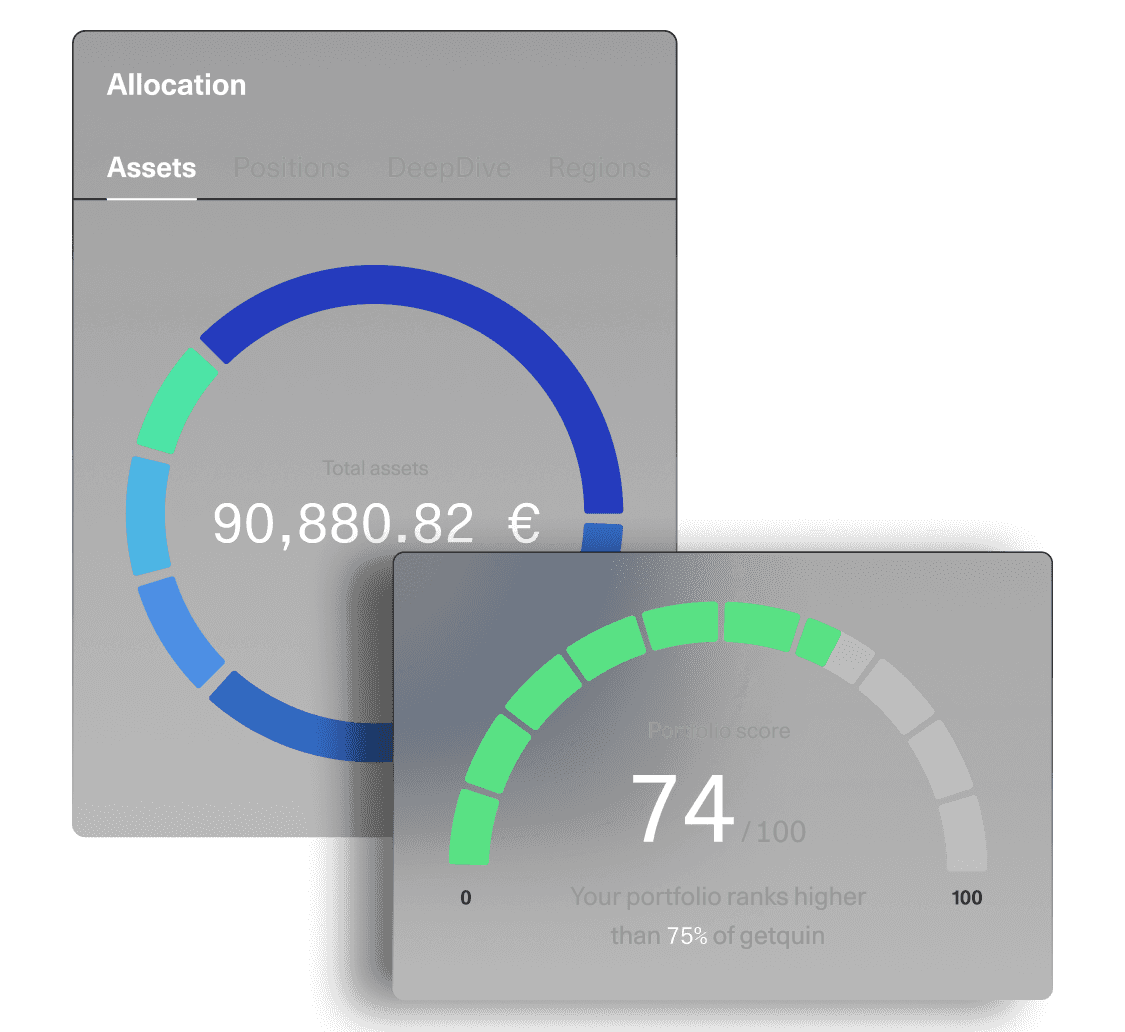

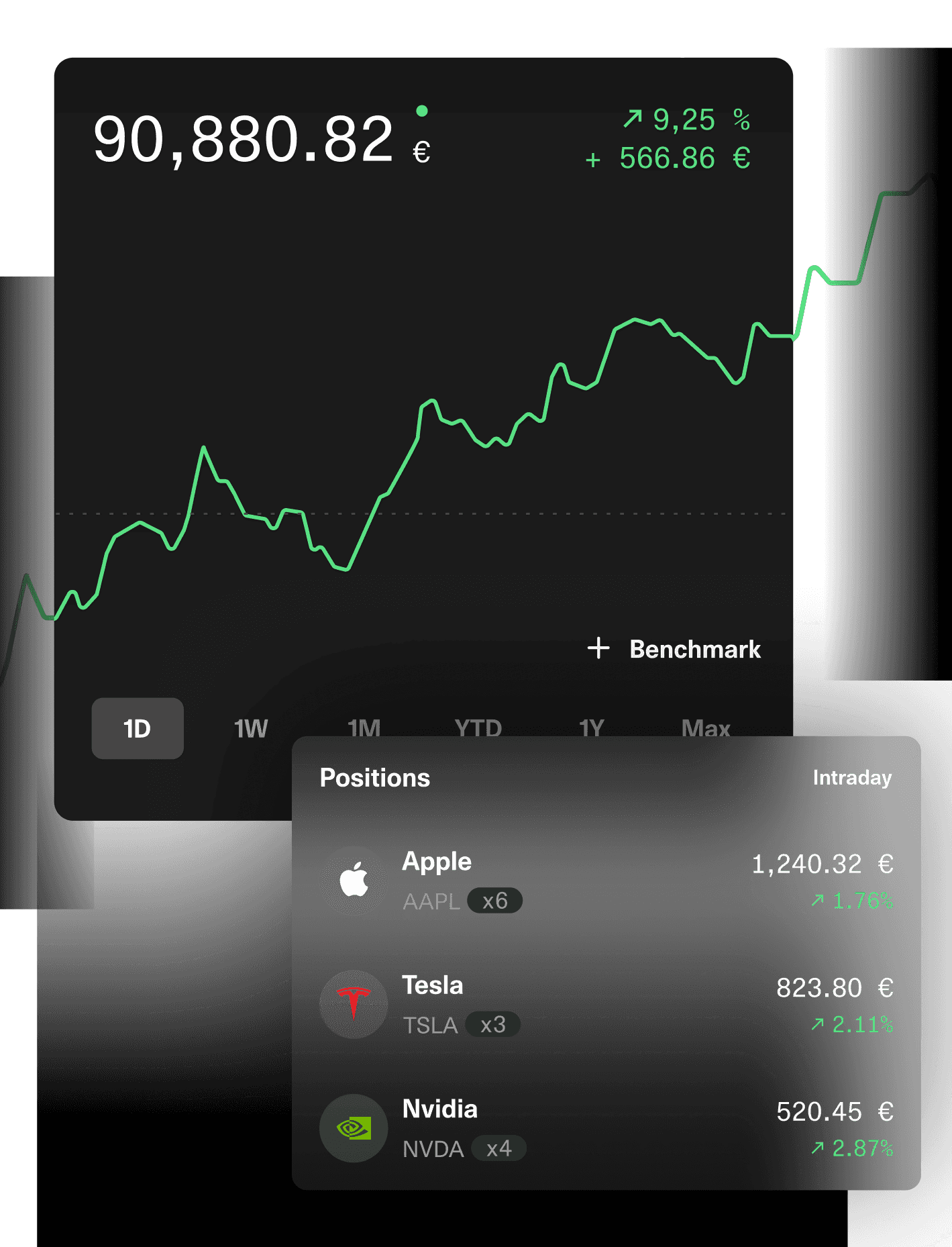

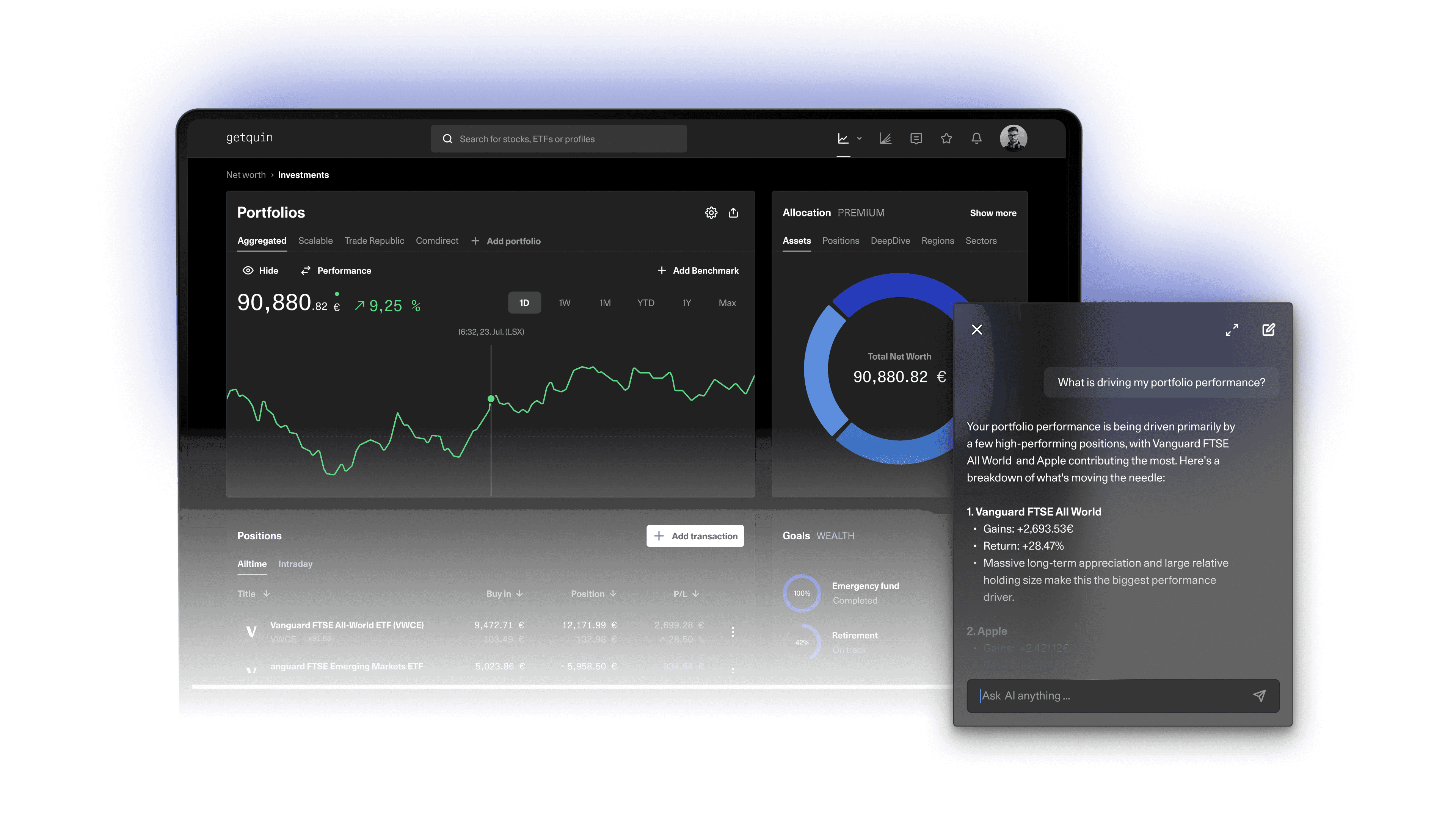

Your entire wealth. One platform.

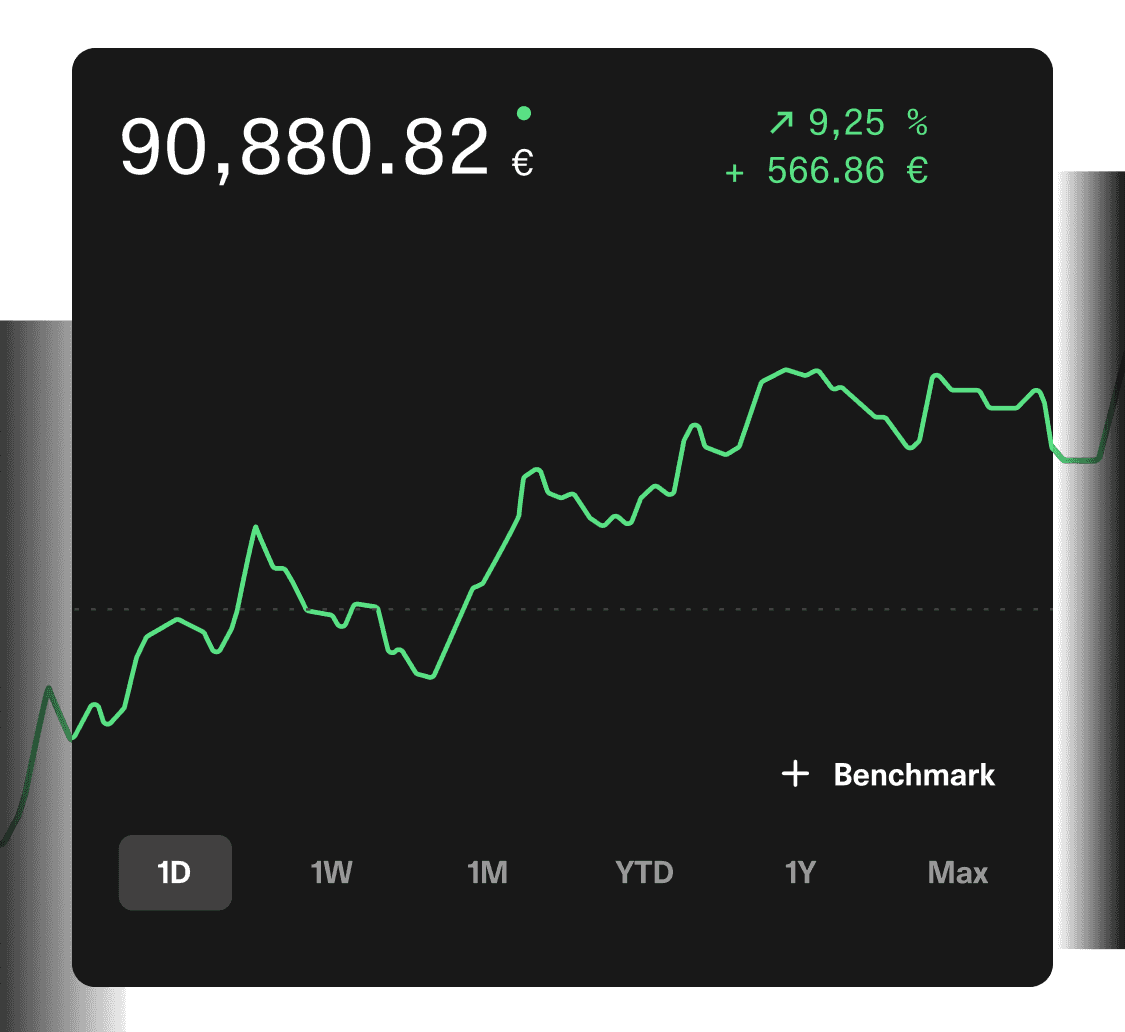

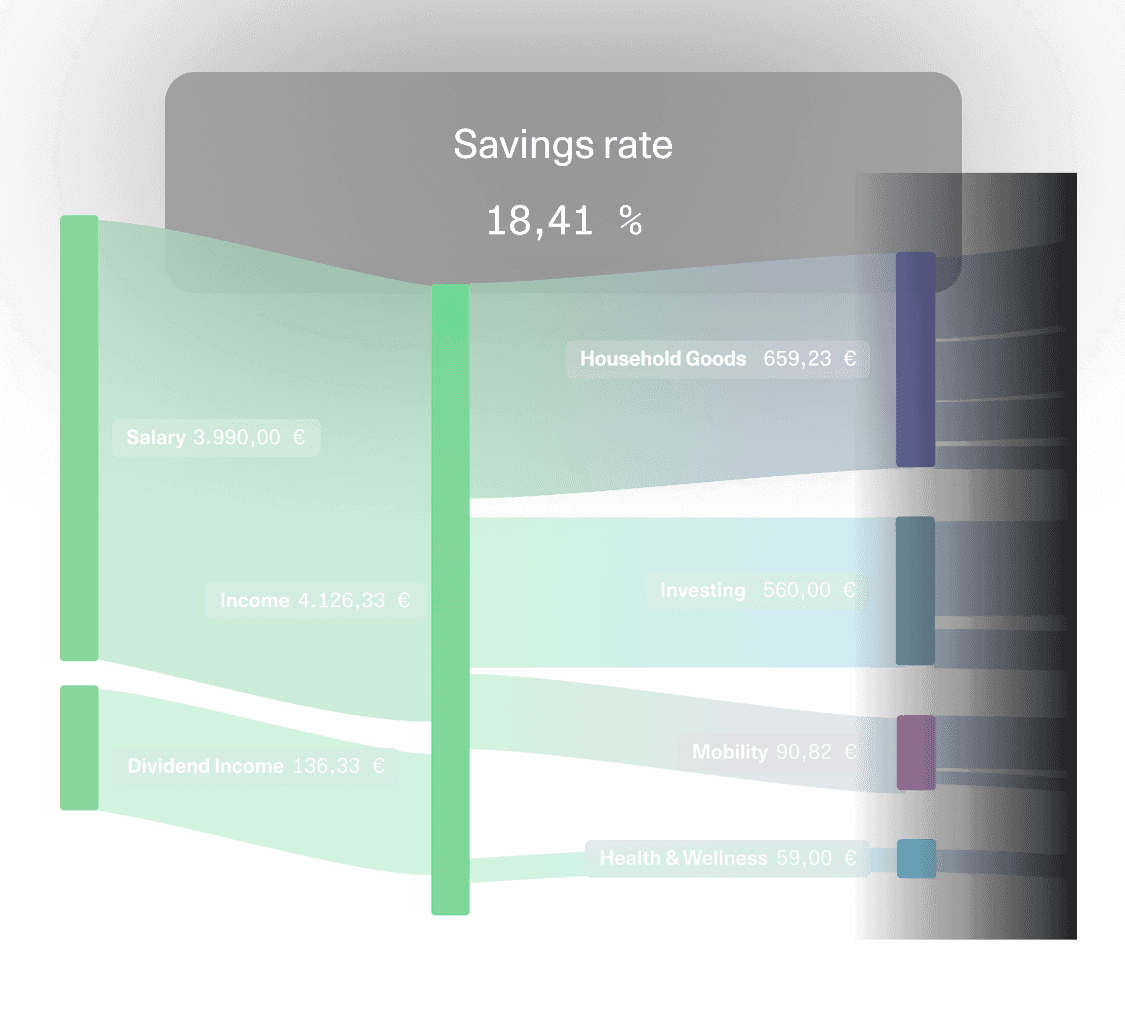

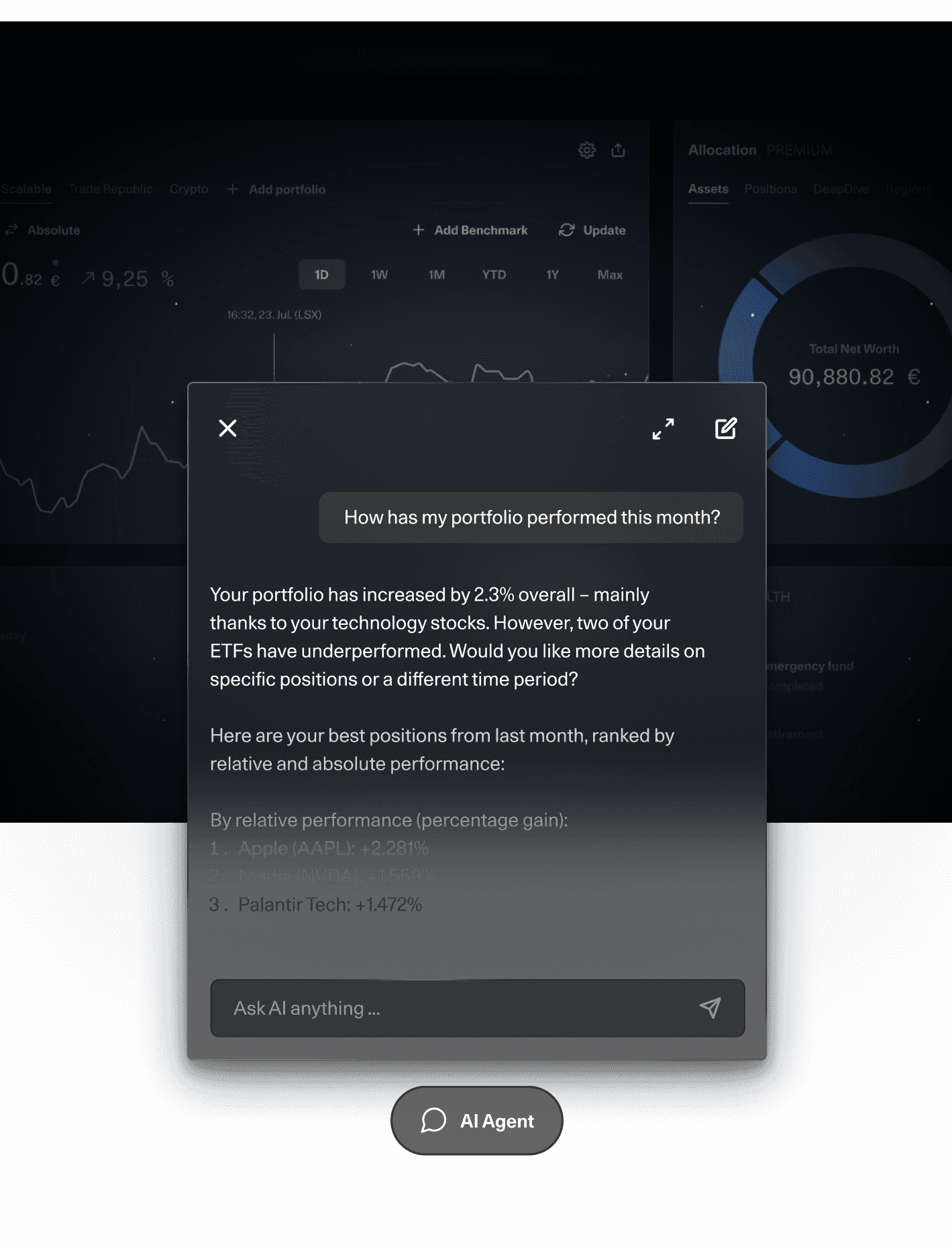

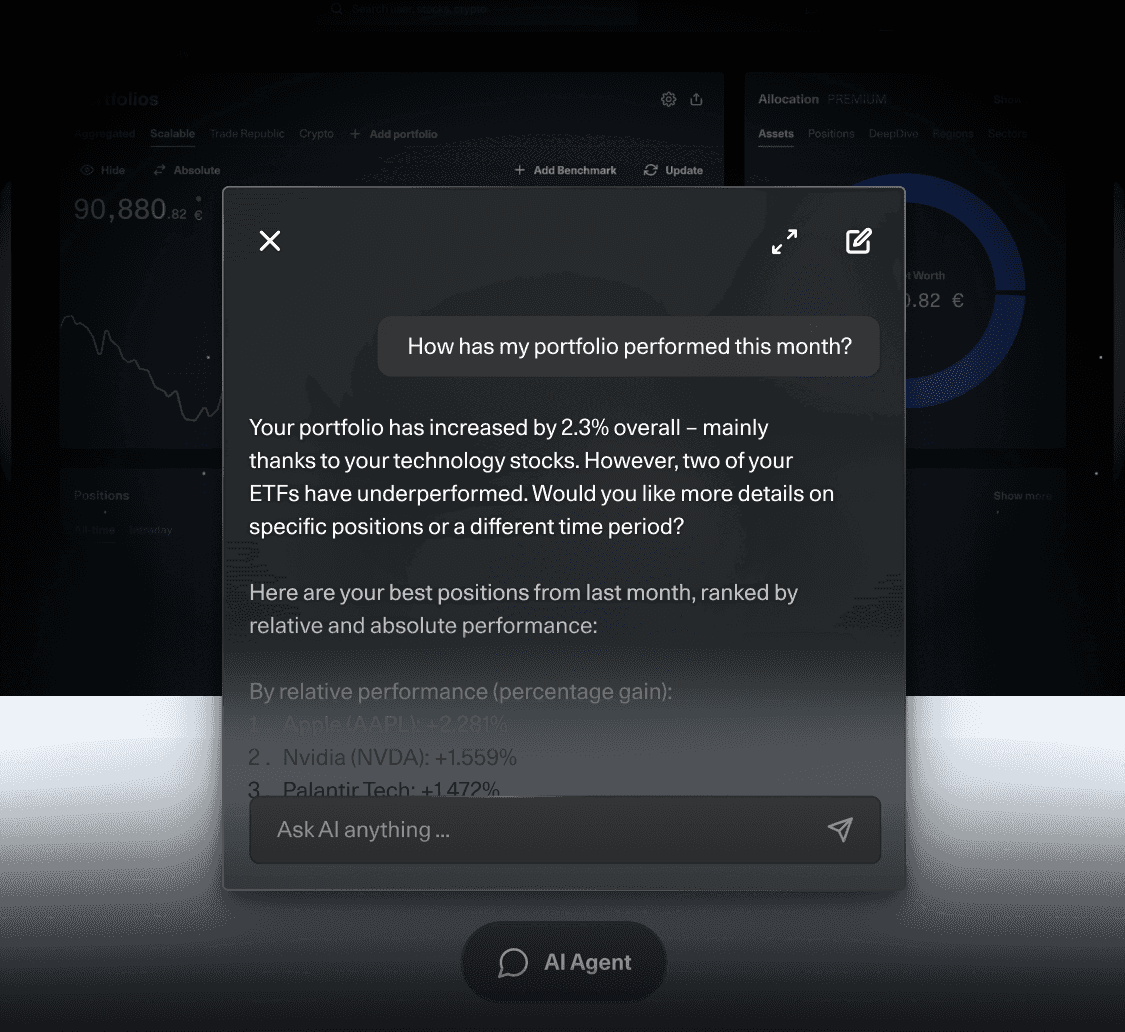

Track your net worth, plan for retirement, and optimize your wealth with powerful analytics, AI tools, and expert advice—all in one platform.

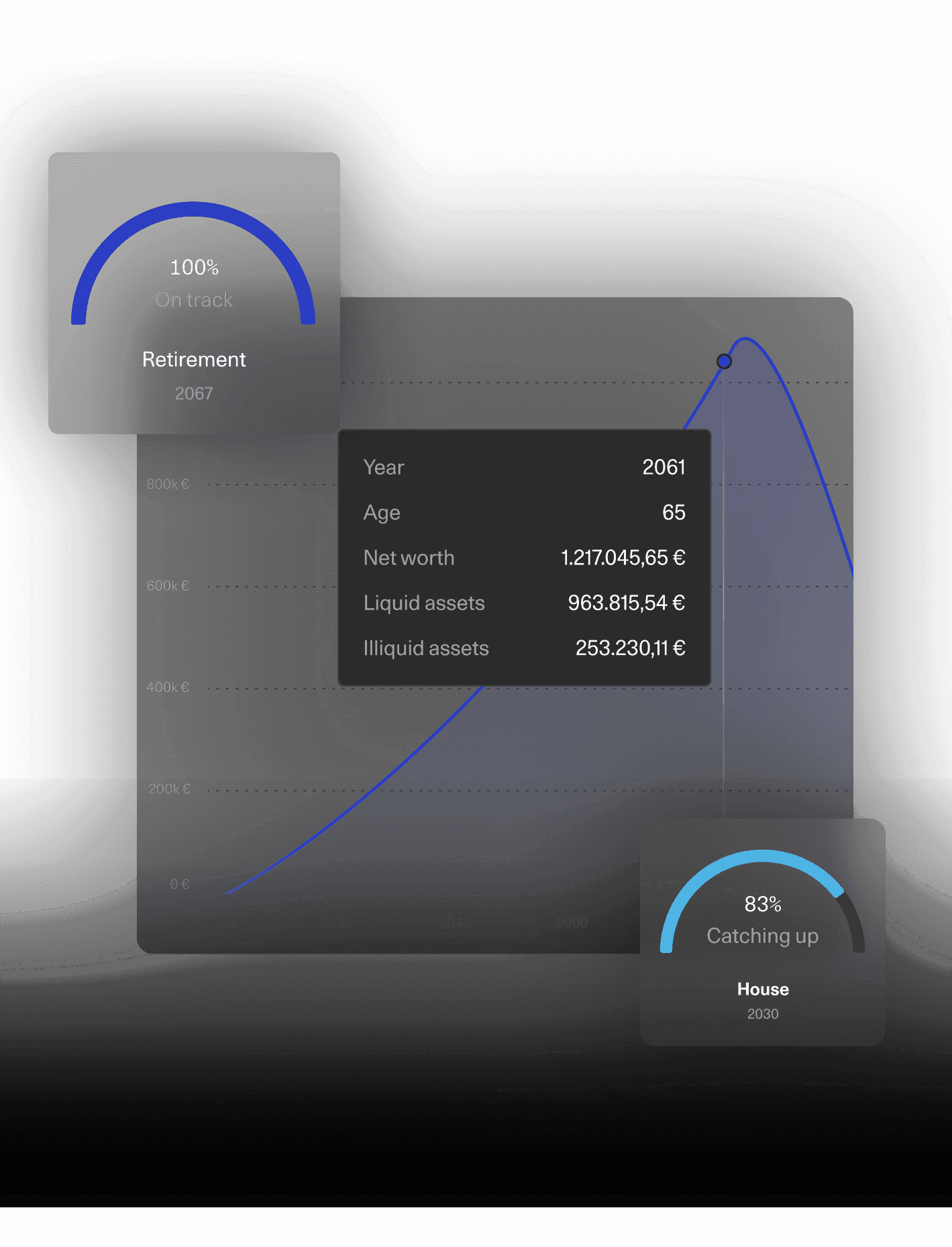

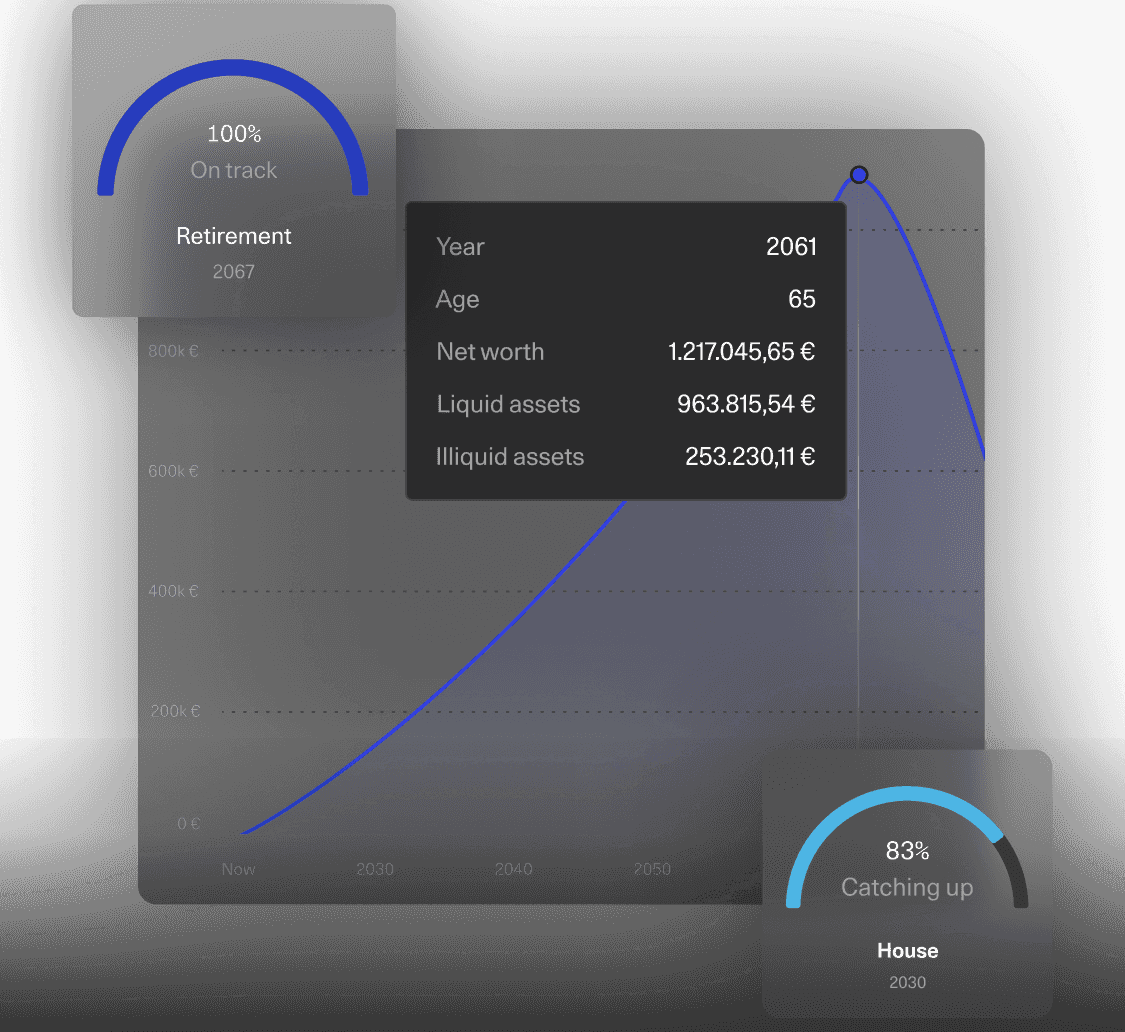

Stay on track to retire, save, and build wealth

Whether it’s retirement planning, saving for a home, or achieving financial independence—set your goals and create a personalized financial plan. Explore different life scenarios and track your progress in one integrated planning platform.

Maximum protection for your data

Protecting your privacy is just as important as securing your data. We only collect the information we absolutely need, ensuring that your identity remains anonymous. With state-of-the-art encryption, no one can access your data – not even us. Your security and privacy are always safeguarded.

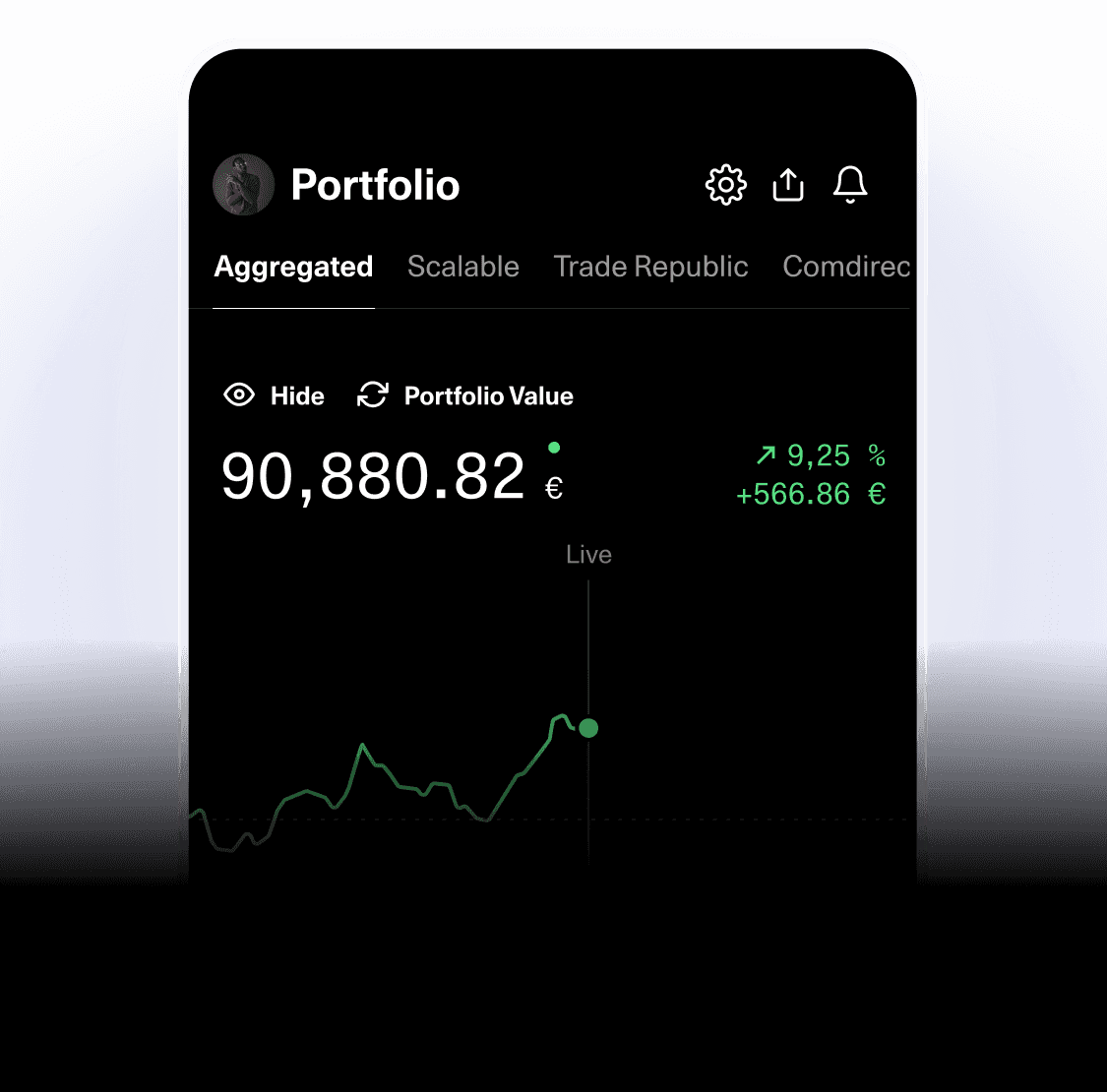

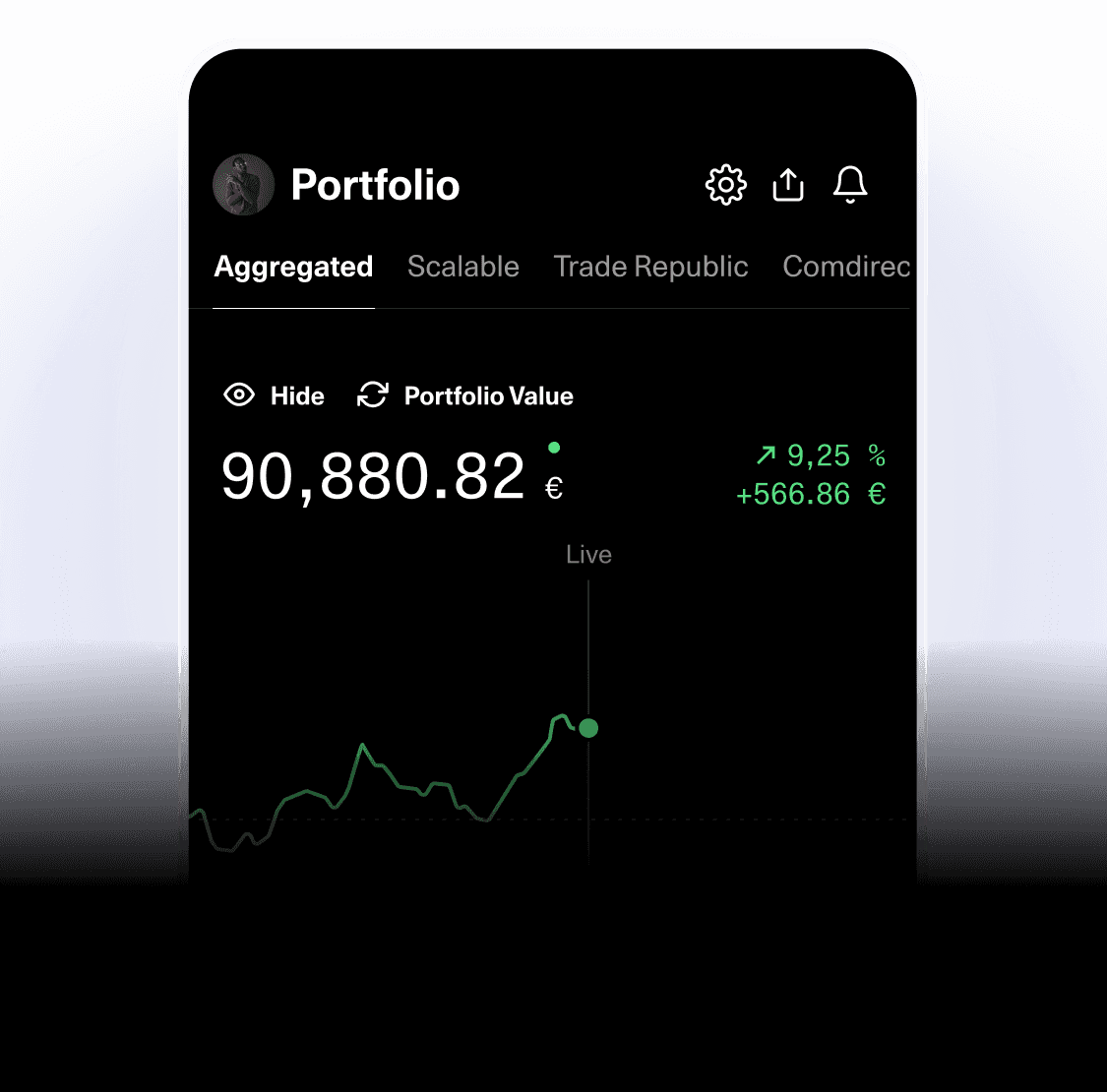

Accessible on all devices

Access our application easily through any web browser or download our lightning fast native iOS or Android app.