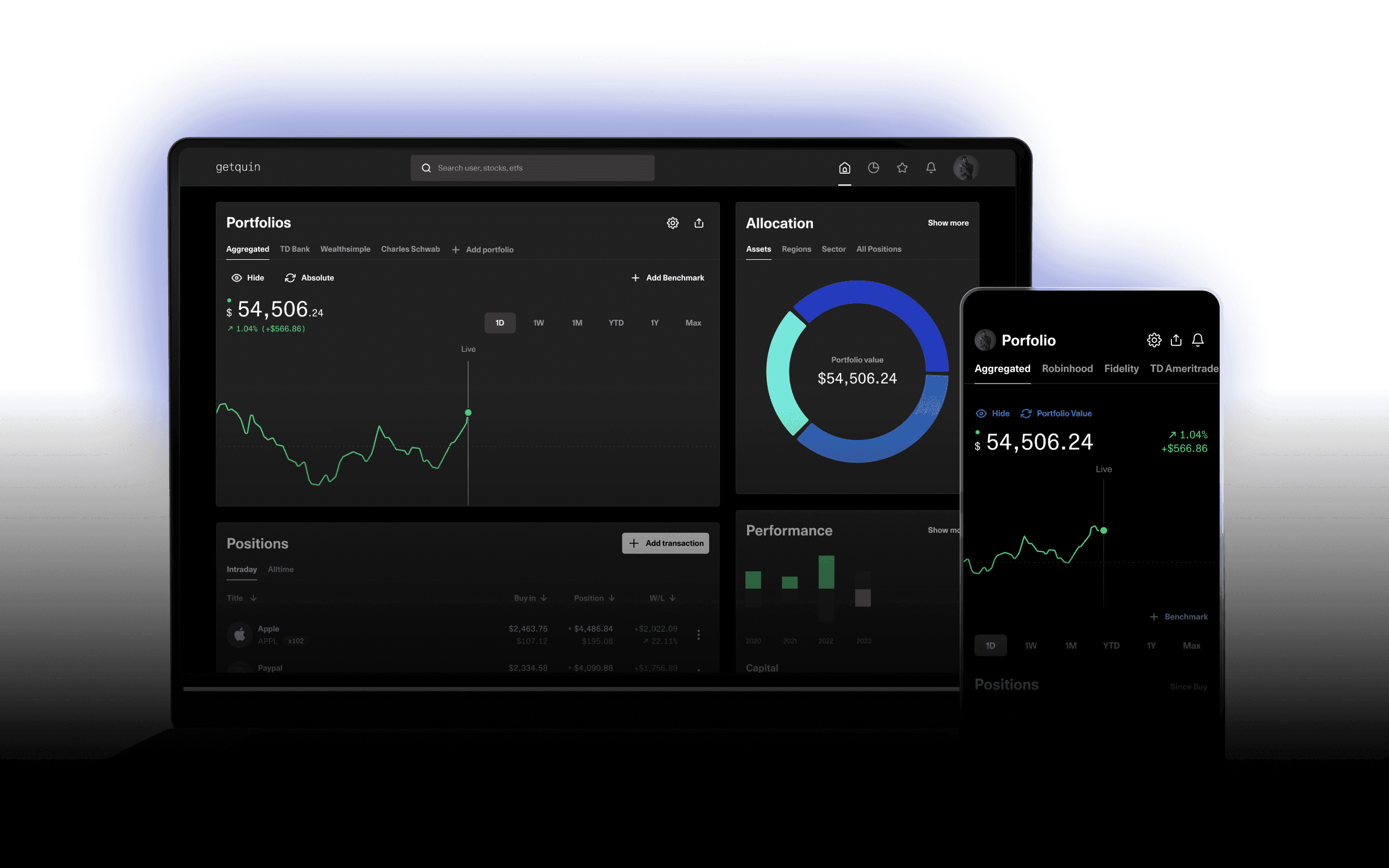

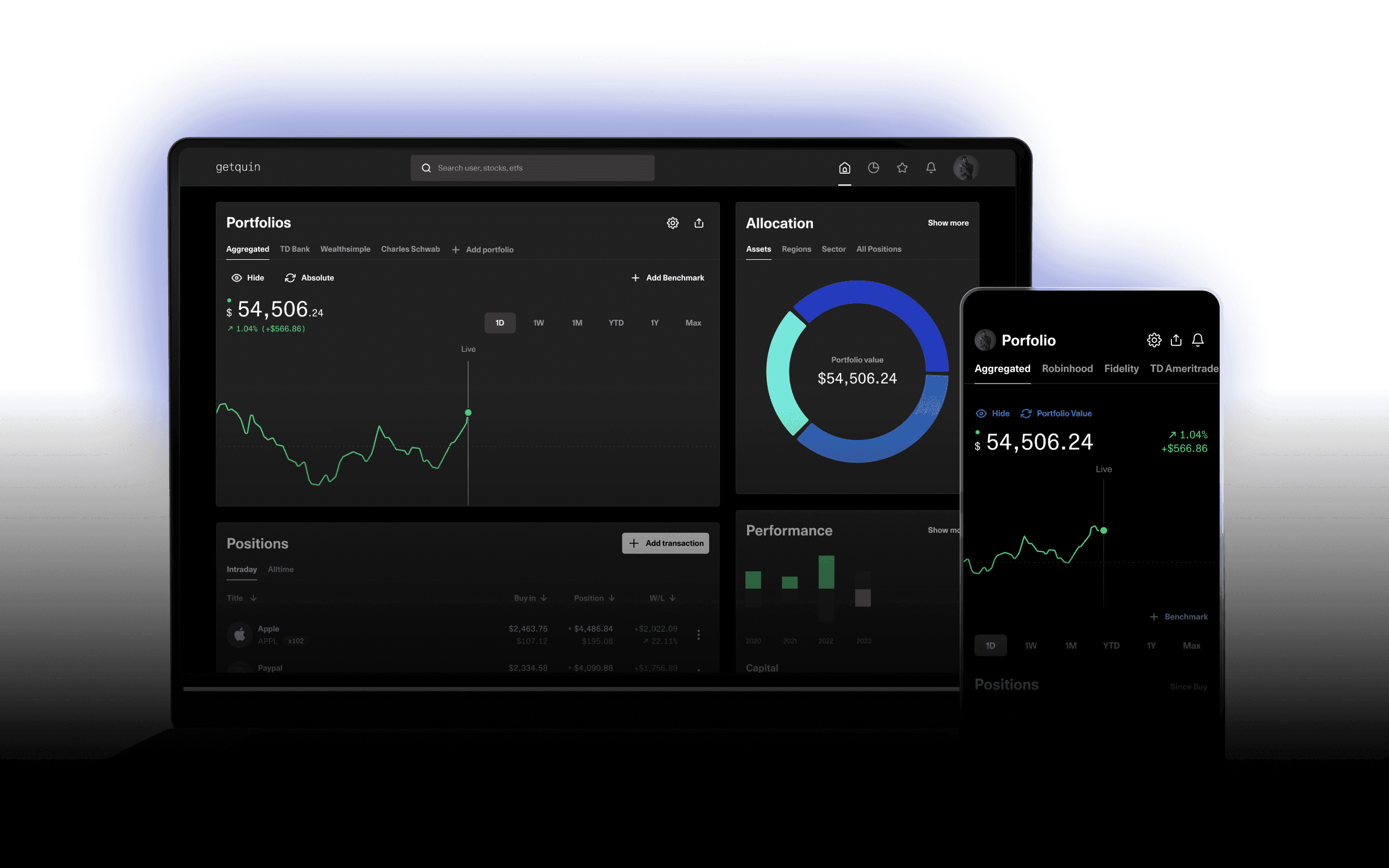

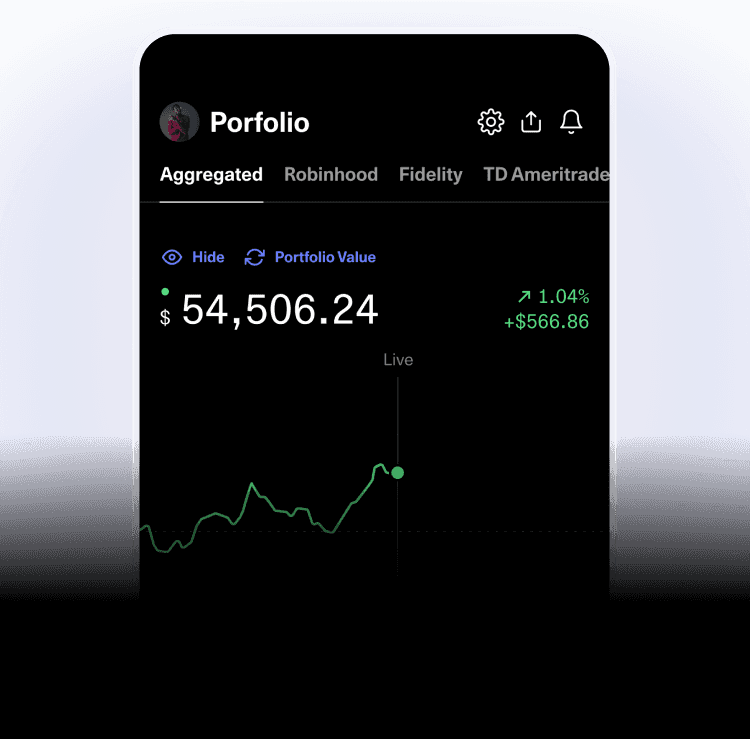

All your investments. One app. Total control.

Aggregate all your investments in one app and gain valuable insights through detailed analysis.

See your real profits

The True-Time-Weighted-Rate-of-Return (TTWROR) provides you with an accurate view of how your investments truly perform, including dividends, realized gains, taxes, and fees. With additional metrics like IRR, Sharpe Ratio, and Max Drawdown, along with clear visualizations through bar charts and heatmaps, you gain a precise understanding of your actual returns.

Track past and future dividends

Use our dividend calendar to track cumulative payouts, see future dividend forecasts, year-on-year growth rate and dividend yield. Plan your future cash flows and know exactly when your payments will arrive, without the hassle of creating complex spreadsheets. Discover the best stocks to fit your dividend portfolio.

Relevant Information, Tailored Just for You

Receive news and analyses specifically tailored to your investments. Stay informed about the developments of your most important securities and never miss any crucial updates. If you have questions about current events, the community is always there to help.

Maximum protection for your data

Protecting your privacy is just as important as securing your data. We only collect the information we absolutely need, ensuring that your identity remains anonymous. With state-of-the-art encryption, no one can access your data – not even us. Your security and privacy are always safeguarded.

What users love about getquin

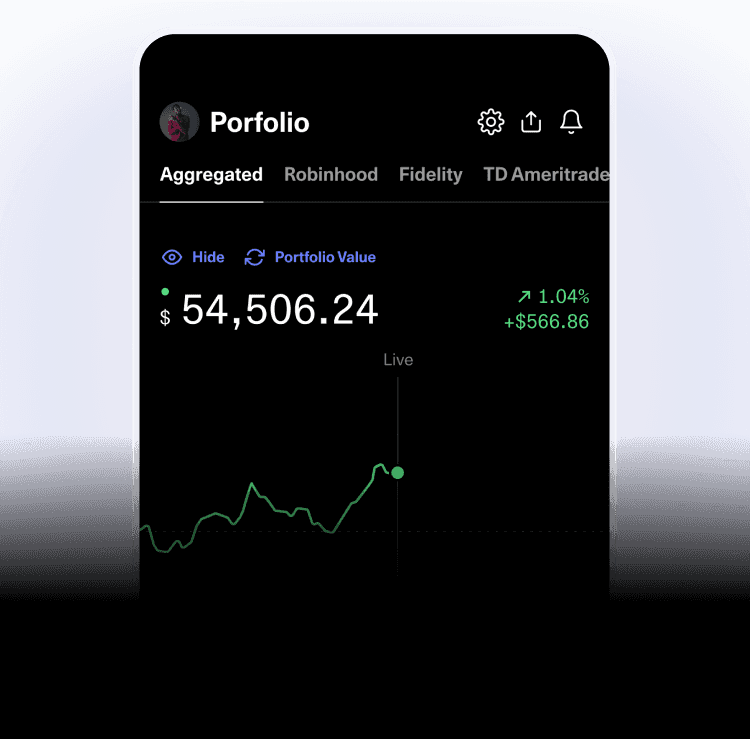

Accessible on all devices

Access our application easily through any web browser or download our lightning fast native iOS or Android app.